Classifying State

Pinto faces the fundamental limitation that it cannot fix the Pinto price at its value target of $1, but instead must encourage widespread participation in target maintenance through protocol-native financial incentives. Low volatility is a function of how regularly the price of 1 Pinto oscillates across its target and the magnitude of price deviations from it.

The protocol has eight direct target maintenance tools available:

Increase the Pinto supply;

Change the Soil supply;

Change the Temperature;

Change the Crop Ratio;

Change the Convert Down Penalty per PDV;

Change the Convert Up Bonus per PDV

Change the Convert Up Bonus Capacity; and

Sell Pinto (Flood).

At the beginning of every Season, Pinto evaluates its position (i.e., price, debt level and liquidity level) and current state (i.e., direction and acceleration) with respect to ideal equilibrium, and dynamically adjusts the Pinto supply, Soil supply, Temperature, Crop Ratio, Convert Down Penalty per PDV, Convert Up Bonus per PDV, and Convert Up Capacity to move closer to ideal equilibrium.

Ideal Equilibrium

The protocol is in ideal equilibrium when the Pinto price, debt level and liquidity level are all at their optimal levels. In practice, this requires that four conditions are met:

The price of Pinto is regularly oscillating around its value target;

The debt level is optimal;

The liquidity level is optimal; and

Demand for Soil is steady.

In order to return to ideal equilibrium, the protocol affects the supply of and demand for Pinto in response to the Pinto price, the debt level, the liquidity level and changing demand for Soil. It does so by adjusting the Pinto supply, Soil supply, Temperature, Crop Ratio, Convert Down Penalty per PDV, Convert Up Bonus per PDV, and Convert Up Capacity.

Pinto supply increases primarily affect the Pinto price. Soil supply impacts the Pinto supply and the debt level. Temperature changes primarily affect demand for Soil. Crop Ratio changes primarily affect demand for Conversions between Pinto and LP token Deposits.

In order to make the proper adjustments, the protocol reassesses the states of the Pinto, Soil and Convert markets at the beginning of each Season.

In practice, maintaining ideal equilibrium is impossible. Deviations from ideal equilibrium are normal and expected. As the protocol grows, the durations and magnitudes of deviations are expected to decrease.

Price Level

Pinto's core objective is to oscillate the price of Pinto above and below its $1 target. The protocol infers the liquidity and time weighted price of 1 Pinto by calculating TWA∆P.

The protocol can be in 3 different states with respect to its price (not including optimal):

Reasonably low price: Price < $1

Optimal price: Price = $1

Reasonably high price: $1 < Price ≤ $1.025

Excessively high price: Price > $1.025

The protocol also uses a Penalty Price, currently set to $1.005, to determine the appropriate Stalk penalty to apply to Convert Downs.

Debt Level

The Pod Rate represents the protocol debt level relative to the Pinto supply. The Pod Rate is often used as a proxy for the protocol's health. If the Pinto supply is 1000 and there are 2000 Pods, the Pod Rate is 200%.

The protocol defines a handful of Pod Rate ranges that it uses as an input to determine how to change the Temperature:

Excessively low debt: Pod Rate < 3%

Reasonably low debt: 3% ≤ Pod Rate < 15%

Optimal level of debt: Pod Rate = 15%

Reasonably high debt: 15% < Pod Rate ≤ 25%

Excessively high debt: 25% < Pod Rate ≤ 100%

Extremely high debt: Pod Rate > 100%

Liquidity Level

The Liquidity Rate represents the protocol liquidity level relative to the Pinto supply. The Liquidity Rate is a useful indicator of the protocol's health.

In the context of the Liquidity Rate, liquidity is defined as the sum of the USD values of the non-Pinto assets in each pool on the Deposit Whitelist. If there is $8M of non-Pinto liquidity in pools on the Deposit Whitelist and the Pinto supply is 16M, the Liquidity Rate is 50%.

The protocol can be in 4 different states in relation to its Liquidity Rate:

Excessively low liquidity: Liquidity Rate < 12%;

Reasonably low liquidity: 12% ≤ Liquidity Rate < 40%;

Optimal level of liquidity: Liquidity Rate = 40%

Reasonably high liquidity: 40% < Liquidity Rate ≤ 80%; or

Excessively high liquidity: Liquidity Rate > 80%.

Direction

The current state of Pinto is in part determined by the direction of change with respect to ideal equilibrium.

The direction of change of the protocol with respect to ideal equilibrium is considered either toward or away from ideal equilibrium, based on the current debt level and price.

When P > 1 (more specifically, when TWA∆P > 0), debt is paid back. Therefore, if there is more debt than optimal, the protocol is moving toward the ideal equilibrium. If there is less debt than optimal, the protocol is moving away from the ideal equilibrium.

When P ≤ 1, debt can only increase or remain constant. Therefore, if there is more debt than optimal, the protocol is moving away from ideal equilibrium. If there is less debt than optimal, the protocol is moving toward ideal equilibrium.

Demand for Soil

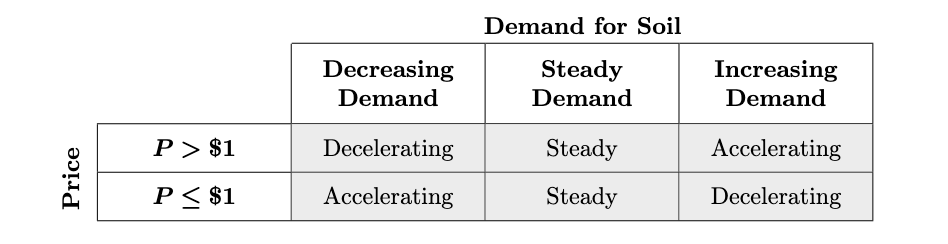

Demand for Soil is a factor in the acceleration of Pinto with respect to ideal equilibrium, which affects Maximum Temperature changes. Demand for Soil is considered decreasing, steady or increasing.

The number of Sown Pinto each Season (ut) indicated demand for Soil over the course of that Season.

The rate of change in the number of Sown Pinto each Season (Delta Demand) is calculated as the number of Sown Pinto in the previous Season (ut−1) divided by the number of Sown Pinto two Seasons ago (ut−2).

Based on this ratio of the number of Sown Pinto over the prior two Seasons, or Delta Demand:

If Delta Demand < 95%, demand for Soil is decreasing.

If 95% ≤ Delta Demand < 105%, demand for Soil is steady.

If 105% ≤ Delta Demand, demand for Soil is increasing.

However, when Pinto is Sown in all Soil in a Season (defined as the lower of 50 Soil or <5% Soil remaining), the Delta Demand ratio is not used. Instead, the protocol checks the following conditions to determine the current demand for Soil:

After a Season in which not all Soil was Sown, if all Soil was Sown in the previous Season, demand for Soil is increasing.

When all Soil is Sown in consecutive Seasons, the difference in time it takes for all Soil to be Sown over the previous two Seasons (where st−2 and st−1 are the times in which all but Soil was Sown in Seasons t−2 and t−1, respectively) can provide a more accurate measurement:

If all Soil was Sown in the first 20 minutes of the previous Season (i.e., st−1<20 minutes), demand for Soil is increasing.

If all Soil was not Sown in the first 20 minutes of the previous Season, the protocol compares st−2 and st−1.

If it took more than 5 minutes longer for all Soil to be Sown in Season t−1 than Season t−2 (i.e., st−1−st−2>5 minutes), demand for Soil is decreasing.

If it took more than 5 minutes longer for all Soil to be Sown in Season t−2 than Season t−1 (i.e., st−2−st−1>5 minutes), demand for Soil is increasing.

Otherwise, demand for Soil is steady.

Acceleration

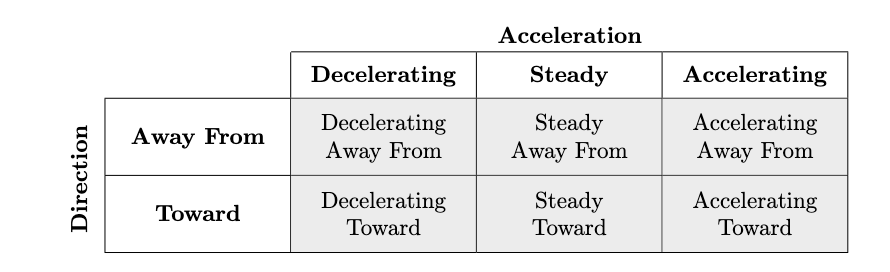

The current state of the protocol with respect to ideal equilibrium is in part determined by the acceleration of change.

The acceleration of the protocol affects the magnitude of Maximum Temperature changes and is considered decelerating, steady or accelerating based on price and the demand for Soil.

Current State

Based on a combination of the protocol's direction and acceleration, the protocol has six potential current states:

Accelerating away from ideal equilibrium;

Accelerating toward ideal equilibrium;

Steady away from ideal equilibrium;

Steady toward ideal equilibrium;

Decelerating away from ideal equilibrium; and

Decelerating toward ideal equilibrium.

Optimal State

The protocol's optimal state is that which moves it toward ideal equilibrium in the healthiest fashion, given the current position.

When the debt level is excessively high or low, an optimal state is accelerating toward ideal equilibrium. When the debt level is reasonably high or low, an optimal state is either steady or decelerating toward ideal equilibrium.

Last updated